La Salle University

Give

The La Salle Fund

The La Salle Fund is the top priority for the University’s annual giving program among alumni, parents, faculty, staff, students and friends. It is made up of thousands of individual gifts each year and collectively helps the University support its mission.

The La Salle Fund provides support across the University where it is essential. Scholarships for students and enhancements across campus are just a few of the examples supported by The La Salle fund. All gifts will be recognized with a gift acknowledgement and receipt, as well as a listing in the University’s Honor Roll of Donors.

Giving Options

The Explorer Fund

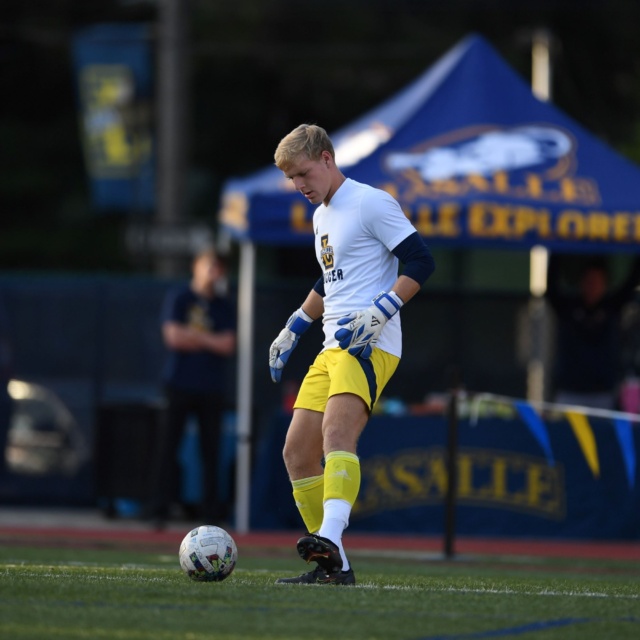

The Explorer Fund provides the resources our athletic teams need to meet the challenges of Division I competition and excel at the conference, regional, and national levels. Your investment in the Explorer Fund will go directly to support our student-athletes and is critical to continuing a proud tradition of athletic excellence.

To make a gift, click on a button above or choose a specific team below to donate to: